Prices for car insurance. How to get the best car insurance quote

Written by Joys Carr, Posted in Tips

Prices for car insurance. How to get the best car insurance quote

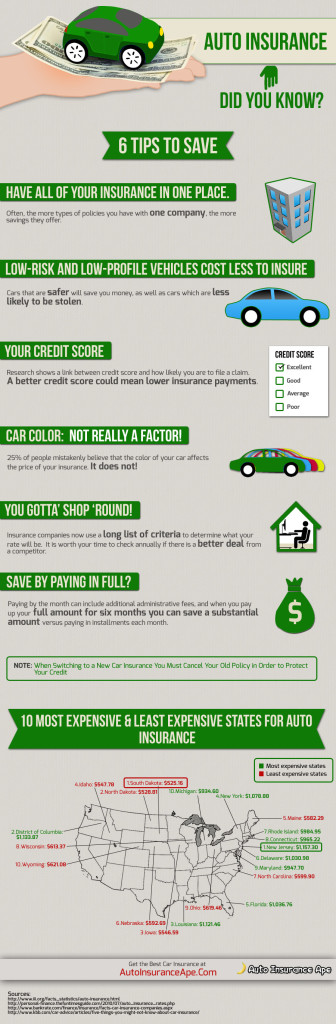

Prices differ from company to company, so it pays to shop around, and get at least three price quotes. You can call companies directly or research the information online. Your state insurance department may also provide comparisons of prices charged by major insurers.

While shopping, get quotes from different types of insurance companies. Some sell through their own agents; some sell through independent agents who offer policies from several insurance companies. And a growing number of insurers sell directly to consumers over the phone or via the Internet.

Lastly, don’t shop by price alone. Ask friends and relatives for their recommendations. Contact your state insurance department to find out whether they provide information on consumer complaints by company. Work with an insurance professional who takes time to answer your questions.

Before you buy a new or used vehicle, check what it will cost to insure. Auto insurance premiums are based in part on the car’s price, the cost to repair it, its overall safety record and the likelihood of theft. Many insurers offer discounts for features that reduce the risk of injuries or theft. You can research safety rankings for specific models with the Insurance Institute for Highway Safety.

Some companies offer reductions to drivers who get insurance through a group plan from their employers, through professional, business and alumni groups or from other associations. Companies offer discounts to policyholders who: have not had any accidents or moving violations within a specified period. Drive fewer miles per year than the average motorist and to those who have taken a defensive driving course.

If there is a young driver on your policy who is a good student, has taken a drivers education course or is away at college without a car, you may also qualify for a lower rate. But one important thing to keep in mind is that the key to savings is not necessarily getting discounts, but the final price. A company that offers few discounts may still have a lower overall price.

- M&S Bank will cut up to 20 per cent off their loyalty cardholders’ car insurance premiums plus it promises 1,000 M&S points to cardholders taking out a new policy. Its also offers up to 90 days cover while driving abroad and uninsured driver protection.

- Churchill offers a 24-hour emergency and legal advice line, an uninsured drivers promise and a five year servicing deal. Experienced and safe drivers could also get an 80 per cent discount for a cover of eight years or more.

- Tempcover insurance could be a good option if you are after cover for a short period of time and Marmalade have a decent offering exclusively structured for young drivers.

- Sainsbury’s offers new customers with a Nectar loyalty card up to 30 per cent discount on their insurance plus they get double points when swiping their loyalty cards on shopping and fuel with the supermarket for up to 2 years. The supermarket giant is also gives free breakdown cover for the first year on its Sainsbury’s Car Insurance or Sainsbury’s Premier Cover Car Insurance until 28th September 2015.

- John Lewis offers a 15 per cent discount when you apply for motor insurance online. Its policies come with a no claims discount of up to 75 per cent.

- The AA offers free breakdown cover for the first year with any new car insurance policy.