Car Insurance: 5 Types of Coverage Explained

Written by Joys Carr, Posted in Types

Understand types of car insurance coverage and how they work

It’s important that you get the right coverage for your car insurance and your situation.

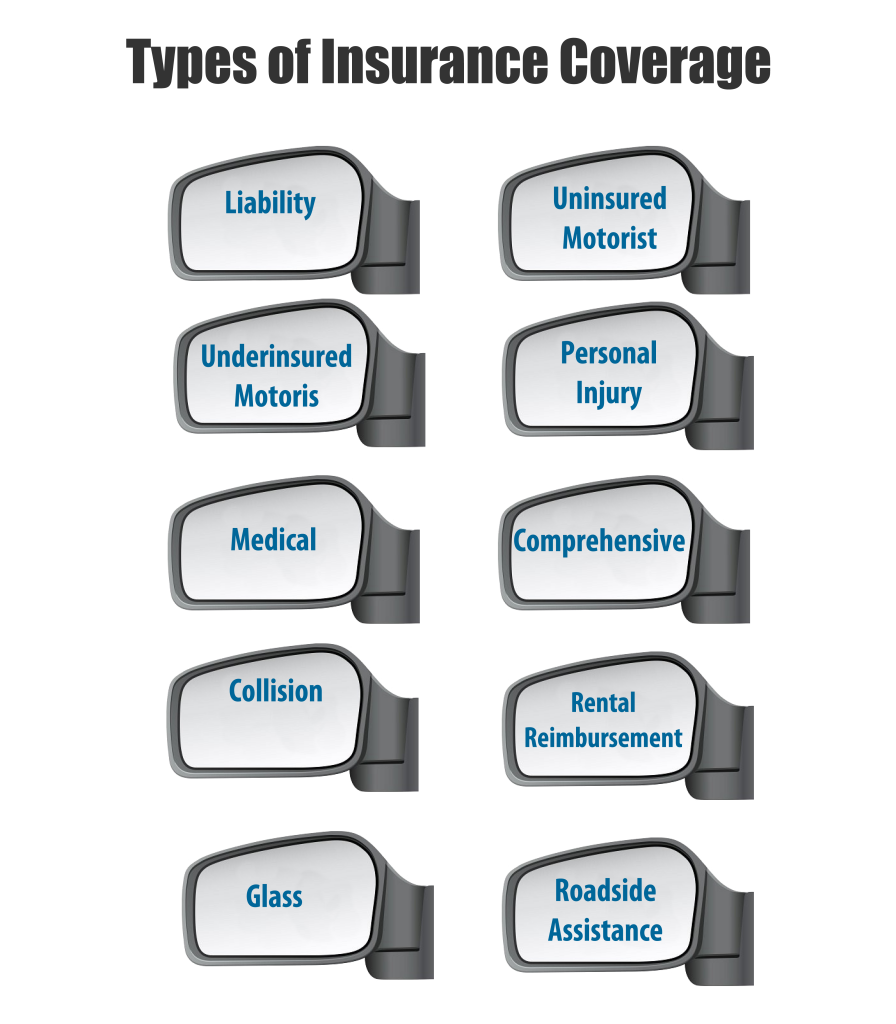

You need to understand what’s available: there’re five main categories or types of auto insurance coverage:

- Liability coverage is the most common because almost every state requires you to carry some minimum amount in order to drive legally. Liability coverage pays for the damage you caused in an accident. Specifically liability coverage pays for bodily injury and property damage of others. Remember that liability insurance does not cover any of your damages; it protect others from damage you caused, and also protects you financially. Without it you could be on the entire cost of an accident out-of-pocket.

- Collision coverage is the second most common type of car insurance coverage. It will pay for damages to your car from an accident, even if you are not in fault. Collision coverage pays for damage occurred when you’re driving and collide with another object. No losses from non-crash stuff like weather damage are not covered by your collision insurance.

Car insurance that pays for weather related accidents

- For those things you need something called comprehensive coverage. Comprehensive coverage kicks in to cover losses that are totally out of your control. Collision coverage comprehensive coverage is optional, it will protect you from losses due to fire, vandalism, hitting an animal or damage caused by certain natural disasters that comprehensive coverage won’t cover. It won’t cover everything: for example most policies will not cover damages for freezing, even though it’s weather-related.

- Comprehensive coverage usually doesn’t cover breakdowns, either if you were hit by one of these people you won’t be able to collect from a liability policy they don’t have uninsured motorist coverage to pay for your medical expenses and lost wages many states.

- Uuninsured motorist coverage for bodily injury review might have the option to purchase the property damage. It is under insurance coverage kicks in when it damages and expenses exceed the limits of the at fault driver’s liability.

Those were all the most common car insurance types. When you’re shopping for an auto insurance policy make sure you know exactly how car insurance works and what you’re getting and why find out what is covered what is excluded what you need to stay legal and what you need to stay protected financially.