Prices for car insurance. How to get the best car insurance quote

Written by Joys Carr, Posted in Tips

Prices for car insurance. How to get the best car insurance quote

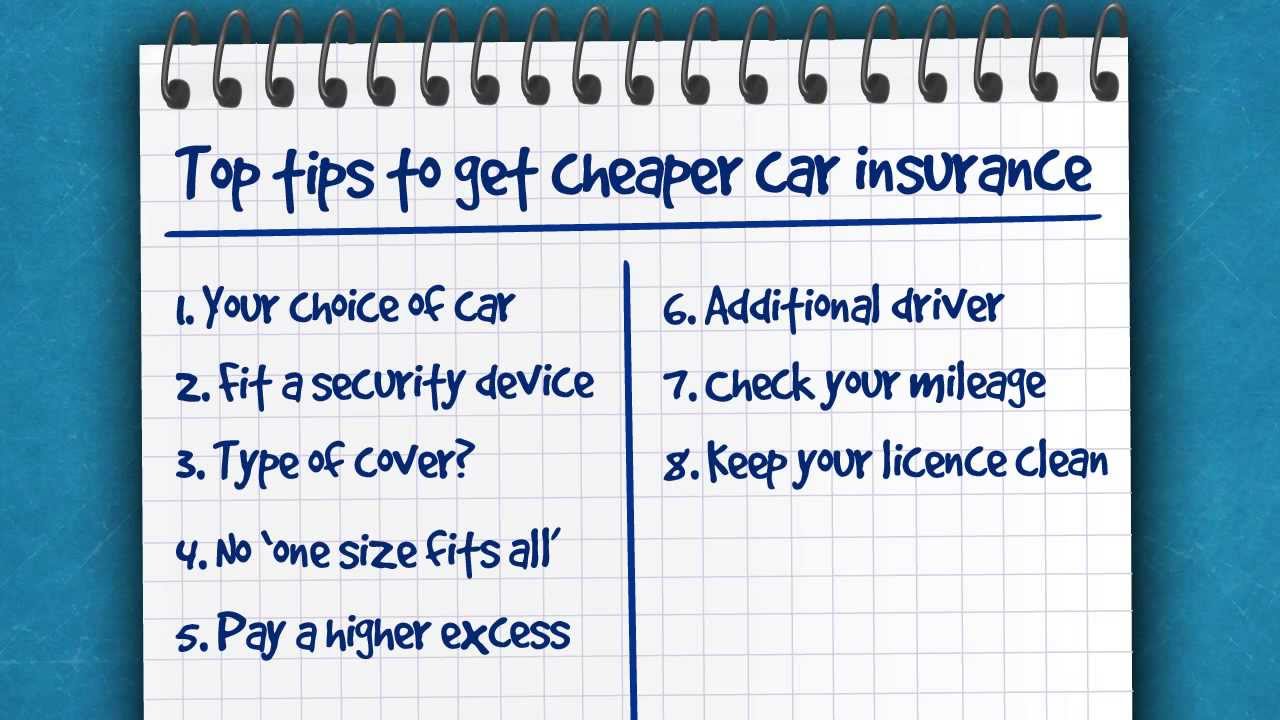

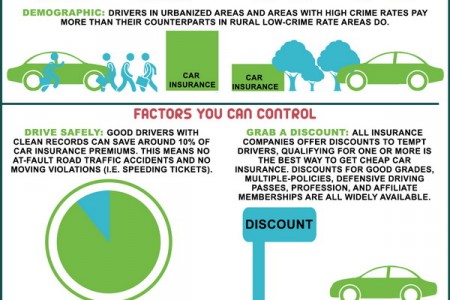

Prices differ from company to company, so it pays to shop around, and get at least three price quotes. You can call companies directly or research the information online. Your state insurance department may also provide comparisons of prices charged by major insurers.

While shopping, get quotes from different types of insurance companies. Some sell through their own agents; some sell through independent agents who offer policies from several insurance companies. And a growing number of insurers sell directly to consumers over the phone or via the Internet.