Full Coverage Insurance for your Car: Benefit and Details

Written by Joys Carr, Posted in Types

Full Coverage Insurance for your Car: Benefit and Details

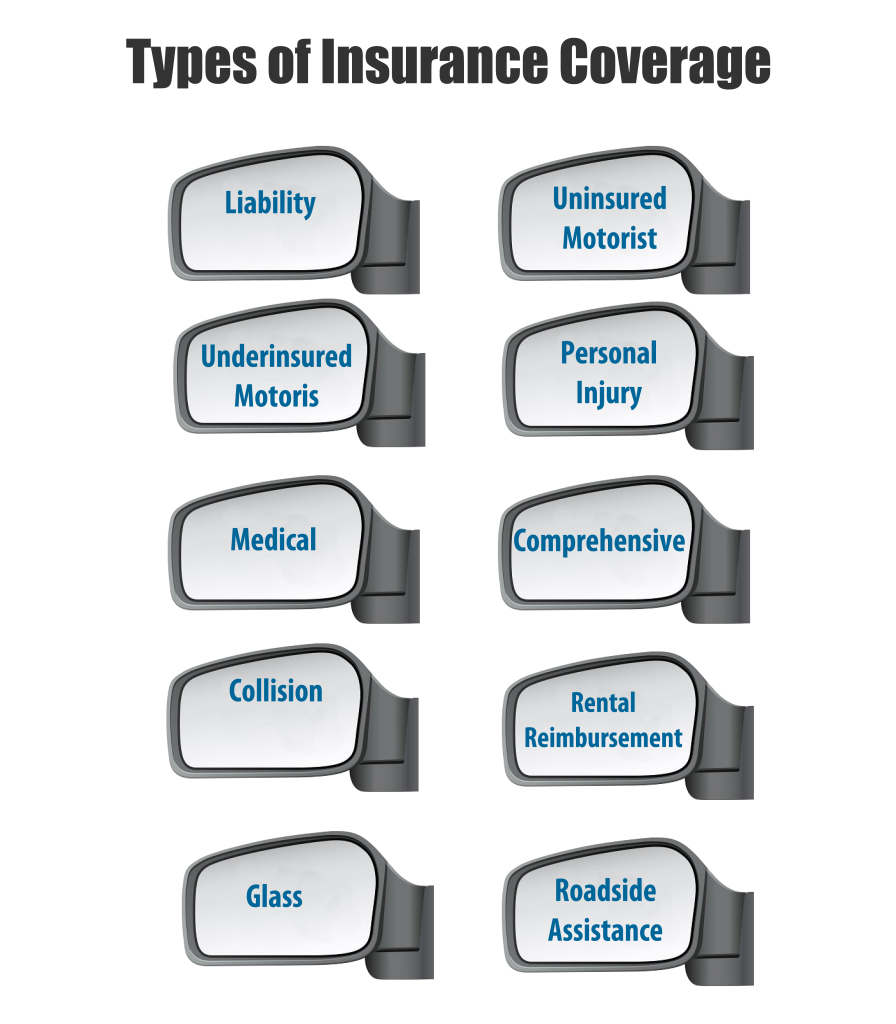

Lets talk about full coverage insurance for your car.

People always ask, how will insurance pay if I’m involved in an accident? I’ve got full coverage, what does that really mean?

Here is what it means, if your fall in an accident the insurance company is going to pay the other person for their loss. If they’ve had damage to their car, their body the insurance company pays first dollar to the people that were either injured or had property damaged.