Car insurance for New Drivers and Teenagers: Definitive Guide

Written by Joys Carr, Posted in Tips

A Definitive Guide on Car insurance for New Drivers and Teenagers

Car insurance for new drivers is really difficult because of the fact that most new drivers are teenagers who’ve never really been known for being responsible or levelheaded from an insurance company’s point of view. It’s also really difficult because Motor vehicles are the leading cause of death.

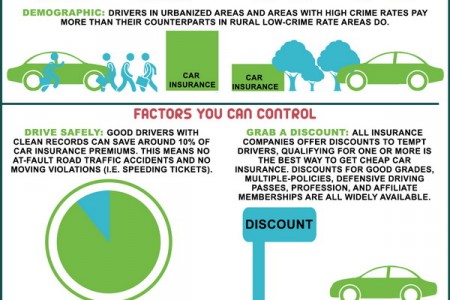

Another reason why new drivers find it so hard to get insurance is that there’s no driving record because they’ve never driven before.There’s no credit history because they’re under 18 and there is no previous insurance coverage so the insurance company cannot look at claims histories.The end result of this is that premiums for new drivers are usually high leading most people to get right to the cheapest option.